High Silica Fiber

Market Outlook 2025 to 2035

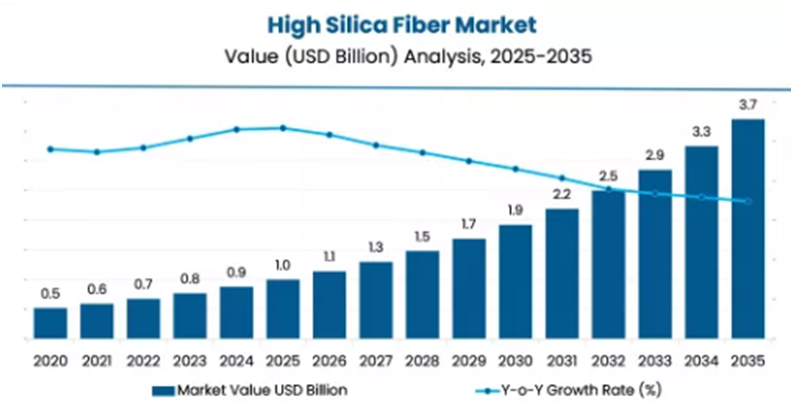

THE global high silica fiber market is projected to increase from USD 1 billion in 2025 to USD 3.7 billion by 2035, with a CAGR of 14% during the forecast period. Growth is driven by increasing usage in heat-resistant applications in aerospace, automotive, and industrial sectors. Their use makes them ideal for high-temperature insulation, thermal protection, and fire-resistant applications in aerospace, automotive, and industrial environments.

Quick Facts about High Silica Fiber Market

- Industry Value (2025): USD 1 Billion

- Projected Value (2035): USD 3.7 Billion

- Forecast CAGR (2025 to 2035): 14%

- Leading Segment (2025): Engine Exhaust Pipe Cover (31% Market Share)

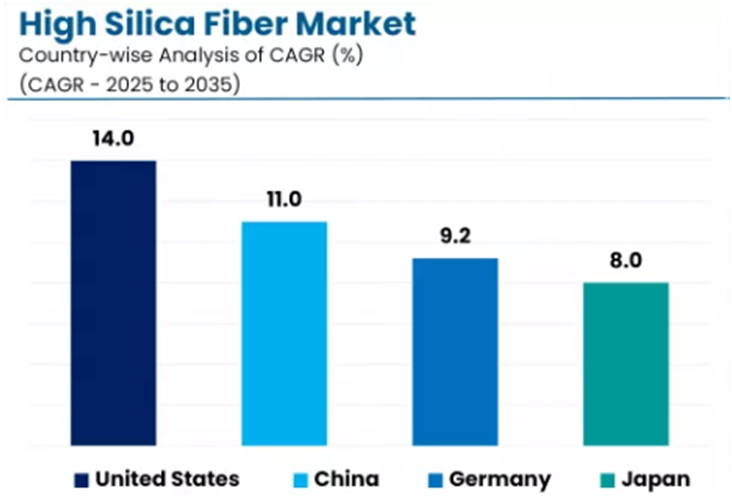

- Country Growth Rate (2025 to 2035): Germany (9.2% CAGR)

What are the Drivers of High Silica Fiber Market?

The upward trend for high performance thermal insulation in aerospace, automotive and industrial developments is an important driver for the high silica fiber market. High silica fibers, are a sophisticated high temperature thermal insulation. They have excellent thermal resistance, low thermal conductivity, and a superior mechanical strength at elevated temperatures. This type of fiber is most commonly adopted in applications such as fireproofing, heat shields, and insulation pieces in the engines of aircraft or exhaust systems, in automotive vehicles.

The technological advances in defense and aerospace systems also contribute to the rapid growth of the market. Government and private industry continue to invest in civilian and military platforms, including next generation military aircraft, spacecraft, and missiles.

This increased investment has a direct correlation to the need for advanced thermal protection in aerospace systems, including high silica fibers, which are extensively used in ablative heat shields, thermal insulation panels, and engine protection etc. Precise thermal protection materials assist to increase the safety and life of mission critical systems.

The transition from traditional industrial insulation using hazardous materials, including asbestos acknowledged for its thermal and fire protection properties only, has transformed to sustainable to non-asbestos materials, such as high silica fibers.

Industries like metallurgy, petrochemicals, and power generation are increasingly considering the shift to high silica fibers over high-temperature ceramics or other non-fibrous insulations. This transition is driven by the fibers’ non-toxic, environmentally friendly properties and superior thermal performance. In terms of chemicals, high silica fibers specific to comply with the needs of industrial work environments.

A further driving force is the increasing weight on lightweight materials to improve fuel economy in the transportation sectors. Because high silica fibers are lightweight and strong, they contribute to manufacturers achieving aggressive energy efficiency and emissions standards while supporting international carbon reduction and sustainable production goals.

In addition, continued R&D to improve with higher quantity and cost efficiency of high silica fibers, they are also showing potential commercial viability. All the emerging economies in a high growth Asian-Pacific region are demonstrating considerable interest in high silica fibers from growth in manufacturing bases and infrastructure.

What are the Regional Trends of High Silica Fiber Market?

North America leads the high silica fiber industry based on demand from the aerospace, defense, and industrial insulation industries. The U.S. government prioritizes military modernization and investment toward the frontiers of space and as a result has steady demand.

High silica fibers are used for thermal protection systems, jet turbine engines, and fire barrier protection in aerospace applications. The industry prefers domestic sourcing as well DFARS compliant products over non-domestic source products. This demand drives regional production despite associated costs.

The Europe region is experiencing stable growth in high silica fiber, driven by regulatory compliance related to environmental issues, such as the use of non-toxic insulation materials. The automotive and construction industries replace asbestos based insulation with silica-based insulation alternatives whenever possible.

High silica fibers are non-toxic and environmentally friendly. Germany, France, and the U.K. have adopted high silica fibers based on their industrial base and advantageous sourcing. The focus on carbon footprint and reduction in carbon emissions (2050 sustainability targets) is also fueling demand for lightweight, high-performance fibers.

The Asia-Pacific region is growing the fastest - China, India, Japan, and South Korea. The expanded demand is the combination of the growing manufacturing, infrastructure, and defense industries. China, because of its low-cost labor and material historically has a major share of the global markets for the amount of high-silica produced. The U.S. companies that have located manufacturing as well as electronics, automotive, and renewable energy projects will fuel future demand and market opportunities.

Latin America is demonstrating new growth on its regionally steep incline, with sustained increases in demand from sectors such as automotive, defense, and oil & gas being influential. Infrastructure development and thermal safety regulations are slowly developing reasons to increase fiber use; however, existing low levels of local solutions are an obstacle with the high cost of imported materials.

MEA is an evolving marketplace demonstrating more interest in high-temperature and fire-resistant applications. Countries like the UAE and Saudi Arabia are using high silica fibers in industries like energy, construction, and petrochemicals. Hot climates, along with fire safety legislation, both add to higher doses of fiber usage in insulation and fire retardant materials. While it is slower, localized uptake is promising for future development.

What are the Challenges and Restraining Factors of High Silica Fiber Market?

High costs associated with producing high silica fibers remains a significant obstacle. The manufacturing process employs intensive treatments requiring high energy- and therefore the cost of production is significantly higher than conventional alternatives as energy is a large segment of overall costs. For small and mid-sized companies this creates a doubt in proceeding due to potentially high cost constraints.

Equally, supplies of high purity silica of significant quantities that are specifically defined for fiber production are limited. And especially since the quality and repeated quality of raw materials are factors that highly influence fiber performance and the price of raw materials can fluctuate, the availability of raw materials can dry up, and so long cyclical recovery times for production, interruptions in the production life cycle can be extraordinary amounts of uncertainty in a long term sourcing plan.

The production of high silica fiber is technically complex, demanding precise control over chemical and thermal processes, any deviation can compromise quality or reduce yield, leading to increased waste. Additionally, many regions lack the advanced technology needed to manage these processes effectively, limiting growth and expansion opportunities in emerging markets, where reliance on restoring natural fibers further constrains development.

Disparity in International Quality Standards is an obstacle to international trade. Different areas have different definitions of safety, thermal resistance, or compliance norms. This incurs additional certification and testing costs to the exporter. Quality benchmarks that are different from each other also create confusion for end-users.

Many developing countries have low awareness with respect to high silica fiber. Many industries are still using traditional materials such as asbestos or fiberglass. The benefits of thermal stability, and fire resistance are poorly communicated. This will negatively impact demand within cost sensitive and less progressed markets.

High silica fibers are competing with ceramic fiber, aramid fibers, and carbon fibers and composites. These alternative materials are often less expensive, and/or more accessible for consumers. Applications under competitive pressure could limit market opportunity for high silica fibers.

U.S. Market Fueled by Aerospace & Defense Strength

The U.S. market is strongly influenced by the aerospace and defense industry. High silica fibers are in many missile protections, jet engines and thermal barriers in military grade and space-grade systems. Other industries can issue high-performance insulation solutions in industrial sectors such power generation and petrochemicals. As safety issues result in regulatory pressure for safer, non-toxic products, industries are moving away from asbestos and ceramic fibers.

There is a strong pivot toward high-temperature polymers composites and light-weight, heat resistant materials. U.S. manufacturers have begun to weave high silica fibers in protective suits, fire-retardant panels and also develop insulation systems with top coatings. Green manufacturing and automation are creating entirely new approaches to production. Additionally, OEMs have multiplication techniques with 3D printing and silica-based components to introduce electric mobility.

Hopeful government funded R&D and DOD programs also provide melting pots for innovation. Many OEMs and startups are exploring usable silica materials from fibers in new space missions, next-generate aircraft, and specially designed thermal energy storage options. With energy efficiency being a common theme, the applications in HVAC systems in automotive exhausts and in new green buildings will rapidly expand.

China: Dominance Through Scale and Infrastructure Investment

Due to rapid infrastructure development and large-scale manufacturing, China is the industrial leader in the use of high silica fibers. Industries such as electronics, solar, metallurgy, and high-speed rail, are all driving the consumption of these materials. Continued investments in EVs, aerospace, and energy projects will increase the demand for thermal and fireproof insulation materials.

Chinese manufacturers are improving their processes to reduce costs and/or emissions. There is significant momentum occurring in smart material discovery and commercialization, including the incorporation into fireproof fabrics and electrical insulation materials. Several manufacturers are actively utilizing electric furnaces and greener chemistry to meet stricter sustainability standards.

The Belt and Road Initiative is anticipated to unlock long-term demand from infrastructure developments across Asia and Africa. China led R&D is focused on transitioning from raw silica processing to fibre of textile grade. China is well positioned to dominate both in terms of volume, but also to commercialize future applications such as wearable fire protection and EV insulation systems.

Japan Precision Market with Innovation-Led Applications

Economic strength in Japan is based on precision industries, including automotive, semi-conductors and aerospace, which require materials that have structural integrity and high toleration for heat. These high-value applications include lithium battery systems, reactor linings and cleanroom applications that maintain the purity and stability of silica fiber.

Japanese manufacturers maintain ultra-clean and automated production lines with high levels of efficiency. The incorporation of silica fibers into on-board systems such as industrial robotics, high-temperature sensors and electric vehicle systems is accelerating. Longer term product portfolios are focusing on low-carbon, recyclable, and eco-engineered insulation products.

The ability of domestic manufacturers to grow is enhanced by government incentives for re-shoring cri-tical supply chains. Export opportunities are also rising for Japan-based premium-grade silica fibers, particularly in the EU and North America. Collaborative academic industry research and development is taking place for nanostructured silica textiles and is opening high-margin innovation niches for home players.

Category-wise Analysis

Fabrics to Exhibit Leading by Product Type

Fabrics dominate the high silica fiber market because of their popularity in high-heat applications across many industries. Fabrics are flexible, durable, and essential to fire protective clothing, welding blankets, thermal barriers, and aerospace shielding. The marketplace continues to favor silica-based fabrics, as industries continue their transition away from asbestos products and regulations and focus on workplace safety measure are emphasized. Their versatility in custom insulation and as a part of layered composites keep them on the leading edge.

Silica fiber tapes are the fastest-growing segment in the high silica fiber market. They have a thin and compact form, in addition to high tensile strength and thermal resistance, that make them ideal for wrapping, bundling and sealing in tight spaces.

Apart from general applications, they are gaining traction in applications such as aerospace cable insulation, electric vehicle batteries, industrial furnace insulation, and smart manufacturing systems. As industries continue to seek thermal insulation and other performance materials that offer improvements in their controls without compromising space or weight, silica tapes are well-positioned.

Engine Exhaust to Exhibit Leading by Application

The furnace and refractory insulation application dominate the high silica fiber market. These operations require long-term thermal resistance, flame and heat resistance, and resistance to heat over a long, continuous period. High silica fibers provide thermal stability that will not degrade from chemicals encountered in refractory settings.

This property makes them especially effective in kiln, boiler, and lining systems used in industry. The primary industries that adopt this property are glass, steel, and ceramics. Demand for high silica fiber thermal insulation will continue to grow as the world's energy consumption increases and infrastructure grows. This segment will grow due to replacement of existing equipment and new plants being built.

Engine exhaust pipe covers are the fastest growing segment in the high silica fiber market. As more modern engines operate at higher temperatures in accordance with efficiency requirements, the need for more advanced and effective thermal shielding increases. High silica fibers also significantly outperform wraps because of their low thermal conductivity qualifications, light weight design, and flexibility.

The flood of electric and hybrid vehicle manufacturing and the aerospace industry has added price to their simplicity. Additionally, increased government regulations surrounding emissions and fuel safety has compelled many OEMs to use fire resistant materials in their designs.

Competitive Analysis

The high silica fiber market is becoming increasingly competitive, with global producers such as 3M and Ashland, along with several dozen regional producers, and niche composite material makers.

Given the specialization of the fiber, competition is heavily focused on product performance, temperature resistance and versatility, more than on price. Players in the market primarily differ from other competitors through operational capability, purity of product, scale of manufacturing, and the ability to provide customized solutions.

Innovation is one of the key competitive levers. Companies are investing heavily in R&D and are improving the strength-to-weight ratios of fibers, lowering the emissions generated in production, and producing hybrid insulated products.

From a geographical perspective, cost effective mass production occurs in the Asia-Pacific while premium grade materials are produced in North America and Europe consistent with robust industrial standards for utility and defense applications. This clearly marks a supply chain tiering, with lower-tier players focused on bulk selling into export and fellow market participants focused on a specialized demand for high-specification materials.

Additionally, the vertical integration and control of raw material silica processing and a sudden acknowledgement of the post-processing of products have led to supporting consistent quality through various stages of supply and distribution. Similarly, strategic partnerships with aerospace, automotive, and energy sector stakeholders have enabled the co-development of solutions to application-specific need for the benefit of customer lock-in.

Overall, the competitive landscape is evolving toward higher value-added solutions, greater sustainability compliance, and improved operational agility. Companies that can align their innovations with regulatory trends and major industrial shifts, such as electrification, green building, and thermal management in the EV sector, will be best positioned to capture and sustain market share over the medium to long term.

Recent Development

- In April 2024, Penn State University and Morgan Advanced Materials entered into a five-year, multimillion-dollar Memorandum of Understanding (MOU) focused on advancing the research and development of silicon carbide (SiC). SiC is a semiconductor material that offers superior efficiency at high voltages compared to traditional silicon-based technologies..

- In April 2023, Saint-Gobain Quartz rebranded itself as Saint-Gobain Advanced Ceramic Composites (ACC). This strategic move reflects the company's ambitious plan to diversify its solutions and expertise beyond traditional quartz products and expand into high-potential markets.

Source from: www.factmr.com